23rd to 27th September, 2024.

BACKGROUND

The Insurance Week is a national annual campaign that seeks to sensitize the public on insurance services, its importance and benefits. In Zambia, insurance has traditionally seen lower uptake compared to other financial services. However, there is a growing recognition of its importance and the positive steps being taken to address this. Thanks to the dedicated efforts of various stakeholders in the industry, there is a concerted push to continue raising awareness and educate the public about the benefits of insurance. The campaign first took place in 2013, and has since made significant impact, fostering a greater understanding of how insurance can provide security and peace of mind. Insurance Week is a financial literacy campaign, which aims to ensure that more and more citizens have a good understanding of insurance, and can confidently make use of its products and services. As a result, we are witnessing increased interest and engagement, which is a promising sign of progress in the industry.

RATIONALE & OBJECTIVES

It is widely recognised that financial inclusion is one of the hallmarks of a developed society. Citizens need to understand and have access to financial services, for financial stability and security. The National Financial Inclusion Strategy II (2024-2028) defines financial inclusion as, “access to and informed usage of a broad range of quality and affordable financial products and services that meet the needs of all individuals and businesses in a fair, simple, dignified and sustainable manner.” This is enhanced by the overall vision of NFIS II which is to create; “An inclusive and robust financial ecosystem that provides accessible, affordable and sustainable financial products and services to all segments of the population, which help increase their resilience, improve their financial health and build their confidence in the financial system.” Campaigns such as the National Insurance Week are vital to achieving this vision, because people can only make informed and confident decisions when they are financially literate.

WHO SHOULD PARTICIPATE

We invite all interested stakeholders to make creative use of your branches and networks, to spread the insurance week message. Our stakeholders have included regulators, insurers, brokers, agents, banks, educators, mobile network operators, students, teachers, media houses, and more. We call upon our stakeholders to once again rise to the occasion and make the campaign another resounding success.

2024 INSURANCE WEEK

1) Insurance provides a solution: Everyone faces uncertainty, and financial emergencies are unpredictable. There are also the assured events of retirement, and financial needs at different stages of life. Insurance is there to provide a solution, to meet a need. Currently Zambia is facing climate related risks brought on by the drought faced in the 2023/4 rain season. The effects of the drought have been devastating on both individuals and businesses. Insurance provides various solutions from business interruption, index insurance, credit life solutions and insurance to cover alternative power solutions to name a few.

2) Risk Management: Life is unpredictable, ups and downs are part of the natural pattern of daily living. It is better to be prepared rather than panic which a challenge arises or a loss is incurred. No one is immune to the uncertainties, both individuals and organisations need to have a realistic view of the risks and challenges we face. It is better to be prepared.

3) Preparedness and Resilience: in times like this, insurance encourages proactive planning and preparedness. By investing in insurance, people and businesses (farmers as well) are better equipped to handle crises and recover more swiftly, thus enhancing their resilience against uncertainties. Overall, this year’s theme underscores the importance of insurance as a vital tool for navigating and managing the unpredictability of life and the environment, offering a dependable solution to maintain stability and well-being for all.

EXPECTED OUTCOMES

IW 2024 aims to deliver the following outcomes:

1. Increase industry participation and ownership of sensitization activities.

2. Promote simplified and clear insurance messaging.

3. Promote a better understanding of insurance providers, complaint resolution channels and service options.

4. Improve the understanding of the role of insurance during uncertain times (disasters).

5. Enhance public relations between insurance providers and the general public.

6. Increase the number of citizens that understand how insurance works.

7. Sensitize different age groups, all around Zambia.

ACTIVITIES LINED UP

The Insurance week will be kicked off on 21st September 2024 with an insurance fun day set to take place at Pinnacle Mall. This will be a fun filled morning for the whole family as well as policyholders and regulated entities. There will be entertainment as well as activations, the day is open to insurers, reinsurers, brokers, agents, industry, government agencies and departments. Stakeholders are invited to take up student volunteers for Insurance Week programs. We have groups of students who are eager to participate, and are seeking partners to pledge to take up student volunteers, for activities such as office tours, exhibitions and school visits. All stake holders are invited to partner with us to make this event a success.

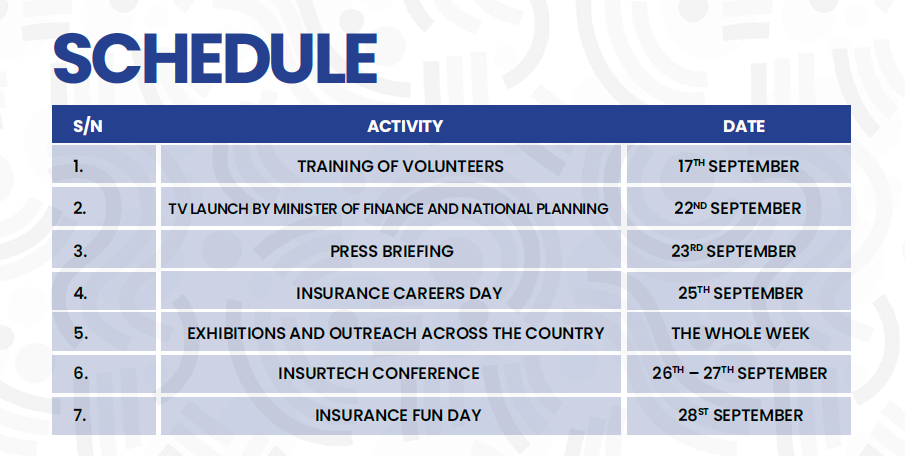

SCHEDULE